Foreign exchange or forex is a decentralized financial market for buying and selling currencies. It is a lucrative field, however, before initiating your trading journey in the foreign exchange market, you need to understand the dynamics of banking networks, market conditions, trading platforms, and more. A forex brokerage helps to establish an ideal link between the forex market and traders. The brokers also enable the clients to trade in other currencies, including those of emerging markets.

Forex brokers are of two types, dealing desk broker, and non-dealing desk broker. A dealing desk Forex broker, or a market maker, takes the opposite side of a client’s trades, and sets the bid and ask price to the traders. The difference between the bid and ask price marks their profit. Non-dealing desk brokers are also referred to as ECN (electronic communications network) brokers or STP (straight-through processing) brokers. They do not take the opposite side of the client’s trades but help them to match with traders who wish to take the other side of a trade.

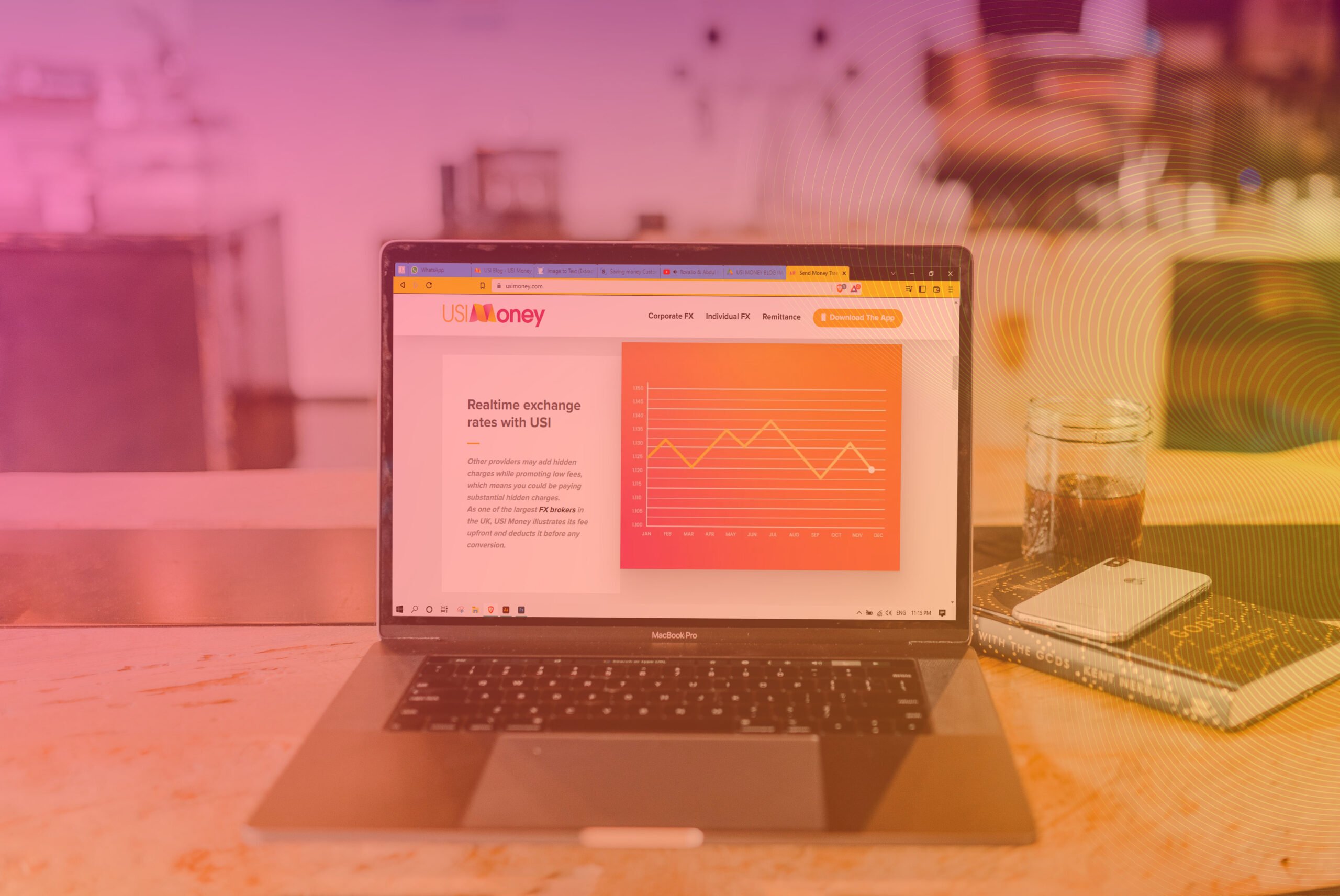

You can search online for the largest FX broker in the UK for your forex trading business. However, choosing the right broker can be daunting. Here are few important tips that will help you to make the right choice.

Evaluate Your Needs

Before you start looking for a broker, you need to figure out what type of investor you are. You should form a clear understanding of your investment goals. Brokers also differ in their platforms, which have different account minimums and transaction fees. You need to determine the budget you can invest in your trading expedition. Try to get most of the preliminary understanding covered before hopping into it.

Trading Platform

You need to ensure that the trading platform that the broker uses to access the investment market is equipped with important technical and fundamental analysis tools. It will facilitate the easy entry and exit of trades. You can also look for customization options to tailor the platform to specific markets.

Experience

Choose a forex brokerage that has a sterling reputation in this niche market. Ensure that they provide reliable services with minimal risks. Check the terms and conditions of their services to identify if they are charging any hidden fees. They should maintain transparency and communication about the advancements, and obstacles. You can also review the customer feedback to understand the potential of your broker. Check the authenticity of the feedbacks for better reliability.

Regulatory Compliance

You should open accounts with brokers who are duly regulated under the standard regulatory bodies. It will help you to ensure the safety of your deposits and the integrity of the broker. The brokers should be regulated under the Securities and Exchange Commission (“SEC”), the Financial Industry Regulatory Authority (“FINRA”), and more. They need to achieve compliance with applicable laws and regulations.

Test Out the Broker

You can personally test out the brokers you are interested in. You can open a demo account, note down the trading conditions, and understand the stability of the trading platform. It will help you to understand its efficiency before opening a live account and begin trading.

To Conclude:

Considering these important factors will help you choose the right broker for your forex trading endeavor. It will enable you to maximize the efficiency of your forex strategy and meet your expectations.