Digital banking has revolutionised the financial services landscape, offering unprecedented convenience and accessibility to consumers and businesses alike. By leveraging technology, digital banks—also known as neobanks or online-only banks—provide a range of financial services without the need for physical branches. While the benefits of digital banking are numerous, there are also significant challenges that need to be addressed. This blog explores both the advantages and the challenges of digital banking.

Advantages of Digital Banking

- Convenience and Accessibility

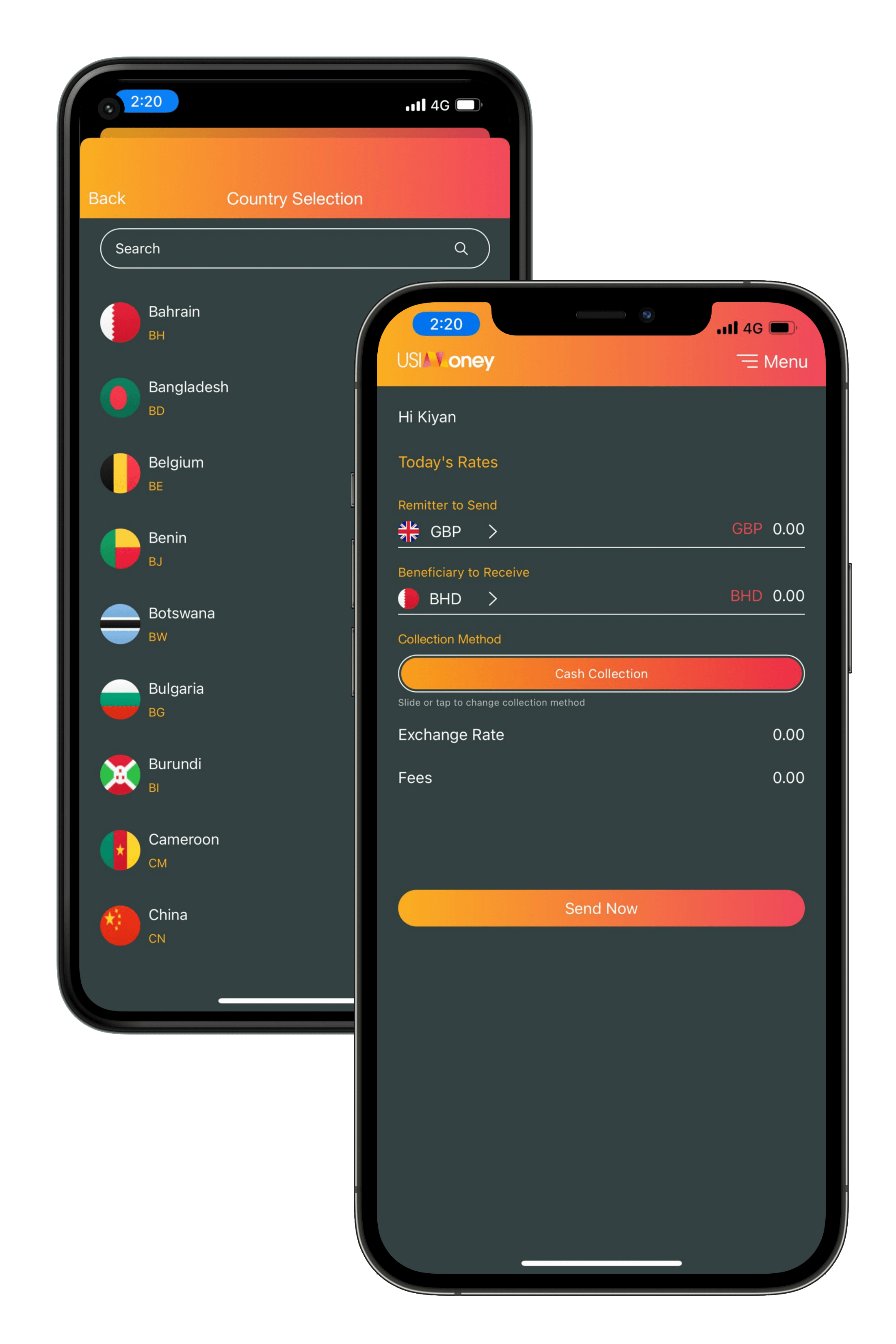

Digital banking allows customers to access banking services 24/7 from anywhere in the world. Whether it’s checking account balances, transferring money, paying bills, or applying for loans, all these tasks can be completed with just a few taps on a smartphone or clicks on a computer. This level of convenience is especially beneficial for those with busy lifestyles or who live in remote areas without easy access to traditional bank branches. - Lower Costs

Digital banks typically have lower overhead costs than traditional banks because they do not maintain physical branches. These savings are often passed on to customers in the form of lower fees, higher interest rates on savings accounts, and more competitive loan rates. Additionally, digital banks usually offer free or low-cost services such as ATM withdrawals, international transfers, and account maintenance. - Enhanced User Experience

Digital banks prioritise user experience by offering intuitive, user-friendly mobile apps and online platforms. These platforms often come with innovative features such as instant notifications, spending analytics, and budgeting tools that help customers manage their finances more effectively. The seamless integration of these features makes digital banking appealing to tech-savvy consumers. - Speed and Efficiency

Digital banking services are designed to be fast and efficient. Account opening processes are streamlined and can be completed within minutes. Transactions, including payments and transfers, are processed quickly, often in real-time. This efficiency extends to customer support, where digital banks use chatbots and AI-driven assistance to resolve issues promptly. - Innovation and Personalisation

Digital banks leverage advanced technologies such as artificial intelligence, machine learning, and big data to offer personalised financial products and services. These technologies enable digital banks to provide tailored recommendations, customised financial advice, and personalised investment options based on individual customer profiles and behaviour.

Challenges of Digital Banking

- Security Concerns

As digital banking involves online transactions and the handling of sensitive financial information, it is a prime target for cyberattacks. Ensuring the security of customer data is a significant challenge. Digital banks must invest heavily in robust cybersecurity measures, including encryption, two-factor authentication, and continuous monitoring, to protect against data breaches and fraud. - Technological Dependence

Digital banking relies entirely on technology and internet connectivity. Any technical glitches, server downtime, or cyberattacks can disrupt services and cause significant inconvenience to customers. Additionally, customers in areas with poor internet access may find it difficult to fully utilise digital banking services. - Regulatory Compliance

Navigating the complex and evolving regulatory landscape is a considerable challenge for digital banks. They must comply with various financial regulations, including anti-money laundering (AML) and know your customer (KYC) requirements. Failure to comply with these regulations can result in hefty fines and damage to reputation. - Customer Trust and Adoption

Despite the growing popularity of digital banking, some consumers remain wary of adopting online-only financial services. Building trust and credibility with potential customers, particularly those accustomed to traditional banking, is an ongoing challenge. Digital banks need to provide exceptional customer service and transparent communication to earn and maintain customer trust. - Competition from Traditional Banks

Traditional banks are increasingly adopting digital technologies and enhancing their online services to compete with digital banks. This intensifies competition and requires digital banks to continually innovate and improve their offerings to stay ahead.

Conclusion

Digital banking offers numerous advantages, including convenience, lower costs, enhanced user experience, speed, and innovation. However, it also faces significant challenges such as security concerns, technological dependence, regulatory compliance, customer trust, and competition from traditional banks. As digital banking continues to evolve, addressing these challenges will be crucial for sustaining growth and ensuring a secure, efficient, and inclusive financial ecosystem.