Terms & Condition Prepaid

Card – an electronic money account issued by us to you including the Prepaid Card linked to your account

Expiry Date – the date on which your card will cease to work.

Account Closure – a fee for redemption where detailed in the Fees and Limits Schedule

Business Day – Monday to Friday, 0900hrs to 18:00hrs, GMT excluding bank and public holidays in the UK

Fees & Limits Schedule – the schedule contained herein;

Fee – any fee payable by the Customer, as referenced in the Fees& Limits Schedule

KYC – Know Your Customer, requirements for knowledge of and information on customers in accordance with Money Laundering Regulations

KYB – Know Your Business requirement for knowledge of and information on the business in accordance with Money Laundering Regulations

SDD Card – Standard Due Diligence Prepaid Card / Instant Issue Prepaid cards

Limitation Period – the period of 6 years following termination of this Agreement

E-money – is the electronically (including magnetically) stored monetary value, represented by a claim on the issuer, which is issued on receipt of funds for the purpose of making payment transactions, and which is accepted by a person other than the electronic money issuer

Merchant – a retailer or any other person that accepts e-money

Payment Services – all payment and e-money services and any related services available to the Customer and/or Additional Cardholder(s) where applicable through the use of the Account and/or card

Reload – to add money to Your Account

Username and Password – login details selected by the Customer to access their Payment Services online

Virtual Card – a non-physical pre-paid electronic payment card, the use of which is limited to on-line purchases or on the phone or mail order

we, us or our – Prepaid Financial Services and / or Universal Securities & Investment Ltd, trading also as USI Money

you or Your – the Customer and/or any person who has been provided with a Card by the Customer for use as an Additional Cardholder where applicable in accordance with these Terms and Conditions

Additional Card holder(s) – Where applicable you may apply for up to 3 additional Prepaid Cards

Schemes or Associations – As shown on your card

1. About Us:

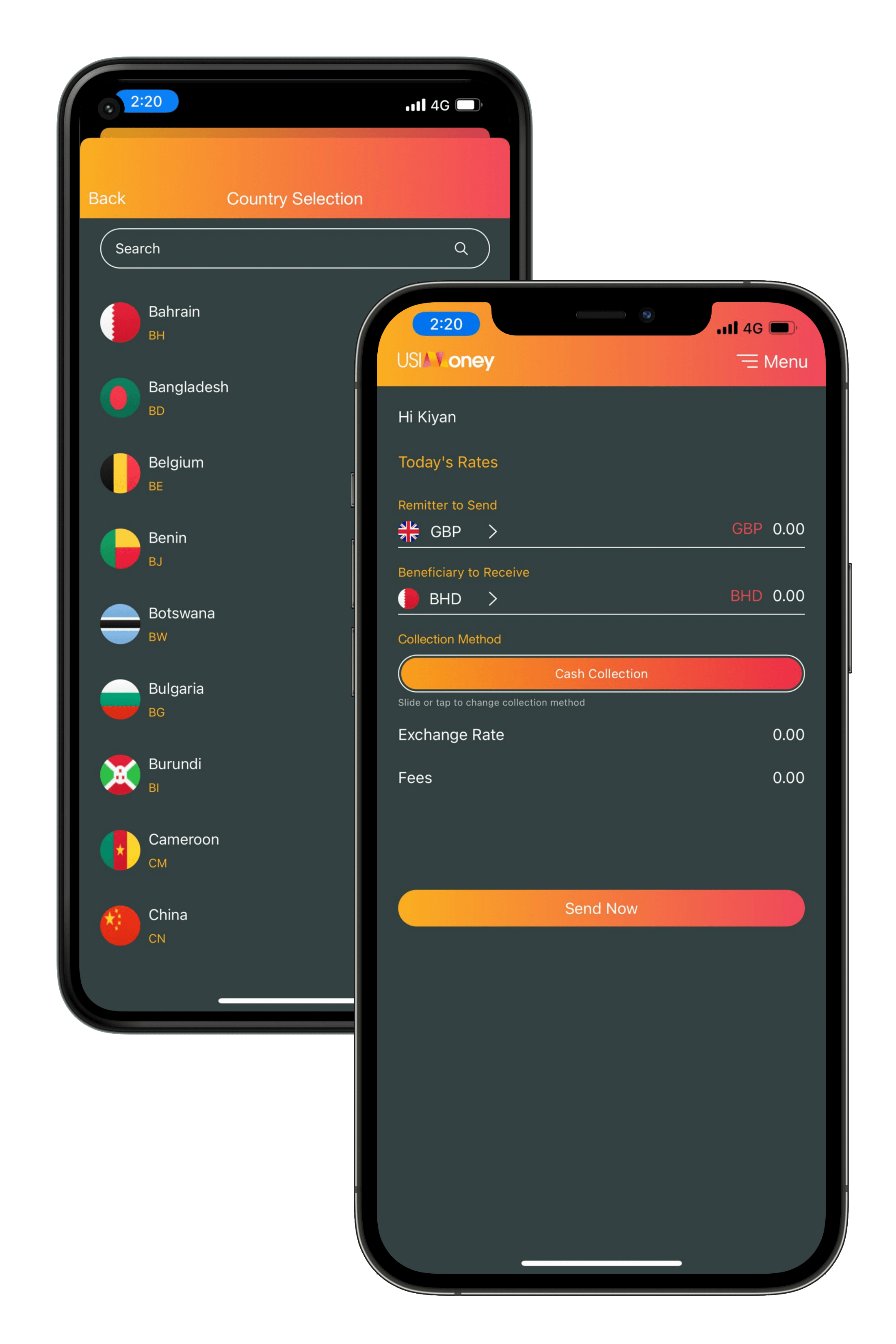

USI Money is a trading name of Universal Securities & Investments Ltd; USI Money is the operator of the programme

Prepaid Financial Services (PFS) is a licensed principal scheme member of MasterCard. MasterCard is a registered trademark of MasterCard International Incorporated. Prepaid Financial Services are the card issuer.

2. Prepaid Card Management:

You can view your transaction history along with your card information online by logging onto www.usimoney.com or calling us on 0207 127 6836 to report your card lost or stolen. If you prefer emailing us then its info@usimoney.com

3. Your Agreement with Us:

3.1. The issuer for Your USI Money Prepaid MasterCard Card is Prepaid Financial Services Limited. The Payment Services are also provided by us, and we are a registered company in England and Wales. Our Company Registration Number is 6337638. We are authorised and regulated as an e-money issuer by the Financial Conduct Authority. Registered Office: 4th Floor, 36 Carnaby Street London W1F 7DR.

3.2. Details of Our authorisation licence by the Financial Conduct Authority is available on the public register at

http://www.fsa.gov.uk/register/2EMD/2EMD_MasterRegister.html

3.3. USI Money operates the Programme on behalf of Prepaid Financial Services Limited.

3.4. At all times your prepaid card will remain the property of Prepaid Financial Services Limited.

4. Your Card and Account with Us:

You may reload your prepaid card subject to the limits provided by the Fees & Limits Schedule. We reserve the Right to vary these limits and to decline any reload at any time. A Reloading Fee may apply.

4.1. These terms and conditions administer the relationship between PFS and USI Money for the providing of the Payment Services by Prepaid Financial Services to you. This Agreement also contains important notices and information that may affect your rights and your ability to recover your money. By activating your account, you shall be deemed to have accepted and fully understood the terms and conditions set out in this agreement and you agree to comply with these by your use of the card and or by indicating your acceptance.

4.2. Your card is not a credit card and is not issued by a bank. You will not earn any interest on the balance of your card.

4.3. The Payment Services are prepaid payment services and not a credit or bank product, you must therefore ensure that you have a sufficient Available Balance to pay for each purchase you make. In addition for all payment or cash withdrawals that you make using the Payment Services

4.4. When you receive your card, You will need to activate it and then retrieve your PIN by calling Our IVR system on +44 (0) 203 327 1991, +44(0) 203 468 4112 or +44(0) 207 183 2248 prior to use. The card will normally be ready for use immediately or on completion of the steps as outlined on the IVR. If you don’t activate your card, then any transactions that you attempt to carry out may be declined.

4.5. Where applicable Corporate Customers, where you have requested us to issue Prepaid Cards and a PIN to your employee(s) you agree to authorise each employee to undertake transactions on your behalf. As the account holder you are responsible for the use of the cards and for any applicable fees or charges that your employees may incur. The use of Your Prepaid Card by Your employees will be regarded as confirmation to us that you have communicated these terms and conditions to them and that they accepted them prior to use. You accept that it is your duty to serve all cardholders with a copy of these terms.

4.6. Prepaid Financial Services Prepaid Cards cannot be shared with second parties

5. KYC / Know Your Customer Requirements:

5.1. In order to purchase a Card, You must be at least 18 years old. We may require evidence of who you say you are and of your current address. You must assist us to comply with our regulatory requirements, applicable to KYC and anti-money laundering requirements on our business. Our regulatory requirements require us to keep records of provided information and documents by you which you also agree to. To satisfy and meet our regulatory and local requirements cardholder KYC documents may be requested and verified prior to the prepaid card being activated and ready for use.

5.2. We do not conduct credit checks on you but at times it may show on your credit file these will be marked by us as a non-credit search

5.3. The purchase of or use of the card will indicate to us that you consent to the checks described in this agreement being undertaken.

5.4. Where applicable you can apply for higher limit cards known as fully KYC cards, these load limits and card benefits are explained further on the company website. To be eligible for these limits you must satisfy clause 5.1

5.5. SDD card load limits are subject to lower limits and available to anyone aged 18 and over. You may upgrade your card (fees may apply) by providing us with your KYC documents. Card holders may be turned down if documents cannot be verified.

5.6. Your prepaid card currency shall be the amount or the local currency equivalent in which your card is denominated. (E.g. Euros €, $ Dollars or Sterling £)

5.7 Where permitted, you may request additional Cards linked to your primary card or account. You authorise us to issue cards and PINs to the additional cardholders and you authorise each additional cardholder to authorise transactions on your behalf. You remain responsible for any fees, transactions, use or misuse of any card or additional card requested by you.

5.8. You agree this agreement also applies to any additional cards and cardholders that you have arranged. You agree to communicate this agreement to any additional cardholders before they start using the card.

5.9. Corporate Customers – To apply for our Prepaid Card you must be a Public or Private Limited Company or partnership. We will require KYB evidence of who you are and your company address. We may ask you to provide some documentary evidence to prove this and/or we may check all information given by you with credit reference or fraud prevention agencies and other organisations. You will also be asked to meet our KYC requirements as set out in section 5.1.

We may perform a search of credit files in order to verify the identity of your owners, directors, partners or employees. The agencies may keep a record of this information and the searches made.

6. Fees and Charges:

All fees applicable to your prepaid card are set out in the fee table below. If we make changes to these fees at any point you will be given a 2 month notice period. If you do not contact us within this time frame we will assume you wish to accept the changes and continue to use your card.

7. How to use Your Prepaid Card:

A card may only be used by the person to whom the card was issued to.

8. Potential Card Restrictions:

8.1. A Card is not linked to a bank account and is not a cheque guarantee card, or credit card.

8.2. You can use the Payment Services up to the amount of the Available Balance for Transactions at Merchants of the relevant system. If the available balance is insufficient to pay for a transaction, some merchants will not permit you to combine use of a card or account with other payment methods.

8.3. Some transactions such as pay at pump may be restricted by the card programme manager

8.4. Some merchants such as restaurants may pre-authorise up to 20% of the full transaction value prior to processing the final bill

8.5. Your ability to use or access the Payment Services may occasionally be interrupted, for example if we need to carry out maintenance on our Scheme. Please contact Customer Services via our website to notify us of any problems you face.

9. Expiry of Your Card & Redemption of Your funds:

9.1. Your card has an expiry date printed on it. The funds on your account will no longer be usable following the expiry date of the most recent Card that was issued under the Account (“Expiry Date”).

9.2. The Payment Services and this Agreement shall terminate on the Expiry Date unless you request or are issued with a replacement Card prior to the Expiry Date in accordance with clause 10.3 or unless we otherwise agree to continue providing Payment Services to you following the Expiry Date.

9.3. You may not use your expired Card(s) after the Expiry Date.

9.4. If a Card expires before Your Available Balance is exhausted, you can contact Customer Services to request a replacement Card on 020 7127 6836, provided you do so 14 days before the Expiry Date and subject to payment of a fee (where specified).

9.5. Notwithstanding any Expiry Date Your funds are available for redemption by contacting us at any time before the end of the 6 year Limitation Period. After the Limitation Period Your funds will no longer be redeemable to you.

9.6. Provided that your request for redemption is made less than 12 months following the Expiry Date redemption will not incur any Late Redemption Fee. In the event that you make a request for redemption more than 12 months after the Expiry Date and before termination of the contract an Account Closure Fee may be charged (where detailed).

9.7. Where applicable Additional Cardholders’ Cards will also expire on the Expiry Date as shown on the Customer’s Primary Card.

9.8. We reserve the right to issue you with a replacement for an expired Card even if you have not requested one. If a Card expires before Your Available Balance is exhausted, you can contact Customer Services to request a replacement Card on 020 7127 6836, provided you do so 14 days before the Expiry Date and subject to payment of a fee (where specified). If you have not requested a replacement Card, you may not be charged a Card Replacement Fee as per the Fees & Limits Schedule.

9.9. We shall have the absolute right to set-off, transfer, or apply sums held in the Account(s) or Cards in or towards satisfaction of all or any liabilities and fees owed to us that have not been paid or satisfied when due.

10. Cancelling Your Card:

10.1. If you are the customer and you wish to cancel the Payment Services at any time, you must request cancellation online by informing us of your wish to cancel and to claim a refund of your unused funds by emailing us as specified in section 2 above. You must e-mail us from the e-mail address you provided when registering your Account. Our Customer Services department will then suspend all further use of your Payment Services.

10.2. You may be asked to provide KYC identity documents as in clause 5.1 to enable us to complete the closure and process a refund for any unspent funds for you.

10.3. Once we have received all the necessary information from you (including KYC) and all transactions and applicable fees and charges have been processed, we will refund to the Customer any available balance less any fees and charges payable to us, provided that:

- you have not acted fraudulently or with gross negligence or in such a way as to give rise to reasonable suspicion of fraud or gross negligence;

- we are not required to withhold your Available Balance by law or regulation, or at the request of the police, a court or any regulatory authority.

10.4. Once the Payment Services have been cancelled, it will be your responsibility to destroy your Card(s).

10.5. You have 14 days from purchase to exercise your “cooling off rights”. We will cancel and return all funds to you subject to clause 10.3

11. Payment Disputes and Complaints:

11.1. If, following reimbursement of your available balance, any further transactions are found to have been made or charges or fees incurred using the card(s) or we receive a reversal of any prior funding transaction, we will notify you of the amount and you must immediately repay to us such amount on demand as a debt.

11.2. We aim to provide customers with easy access to our customer services team who receive record, investigate and respond to complaints. If you are unhappy with any of the services please email us on

info@prepaidfinancialservices.com

11.3. We take complaints very seriously and value the opportunity they provide to assist us with reviewing the way we do business and helping us meet our customers’ expectations. Our primary aim is to resolve any complaints that you may have as quickly and effectively as we can and consequently have documented the steps to be taken below.

11.4. In the first instance, your initial communication will be with Our Customer Care Team. We expect Our Customer Care Team to respond to your complaint in writing within five working days. We will do everything in our power at this stage to resolve this for you.

11.5. You agree to provide us with all receipts and information that we request which are relevant to your claim.

11.6. If our customer service team are unable to resolve your complaint. We will refer to our internal Complaints Officer who will respond to you within 14 working days. You may email them on

complaints@prepaidfinancialservices.com

11.7. If having done and presented our complaints department with all of the information they request from you including receipts and copies of all communications sent and received and you still feel unhappy with our response you are able to escalate your complaint to the Financial Ombudsman Service;

complaint.info@financial-ombudsman.org.uk

The Financial Ombudsman Service, South Quay Plaza, 183 Marsh Wall, London E14 9SR.

12. Lost and Stolen Cards

If your card is lost or stolen you must notify us straight away. The card will be blocked; this can also be done by you if you call our IVR system. You may be liable to pay a replacement card fee. If you later find the card it will not be reactivated so you must destroy the card and await your replacement prepaid card.

13. Changes to the Terms and Conditions:

We may update or amend these terms and conditions (including our Fees & Limits Schedule). Notice of any changes will be given on the website or by notification by e-mail or by means of mobile device at least 2 months in advance. By continuing to use the Payment Services after the expiry of the 2 month notice period, you acknowledge that you indicate your acceptance to be bound by the updated or amended terms and conditions. If you do not wish to be bound by them, you should stop using the Payment Services immediately in accordance with our cancellation policy.

14. Cooling Off Period and Your Rights to Cancel Your Agreement

You have a cooling off period of 14 days starting the date that you have successfully completed registration of your prepaid card with us. You may withdraw from our service without any penalties but subject to deduction of any reasonable costs incurred by us. You may cancel within these 14 days informing us in writing that you wish to withdraw and cancel the agreement you have with us. After the cooling off period you may cancel your agreement with us in accordance with clause11

15. Deposit Guarantee Scheme

The Payment Services, card and account are payment products and not deposit, credit or banking products, as such they are not covered by the Financial Services Compensation Scheme.

16. Protecting Your Money

In the unlikelihood that Prepaid Financial Services Limited was to become insolvent you may lose your funds. However we will do everything that we can lawfully to safeguard your funds for you.

17. Fee Table

The information contained in this fee table summarises the USI Money Prepaid Card features in order to explain which fees are applicable. The fees are not intended to replace any of the terms and conditions set out above.

| Description | Fees |

| Card Purchase | |

| Card Purchase Fee | £14.99 |

| Monthly Service Charge | FREE |

| Loading Transactions | |

| Internet Credit Card Load | 2.50% |

| Internet Debit Card Load | FREE |

| SMS Credit Card Load | 2.50% |

| SMS Debit Card Load | FREE |

| Post Office | 2.50% |

| Payzone | 2.50% |

| Load Fees & Limits | |

| SMS Balance Check | FREE |

| SMS Card to Card Transfer | £1.00 |

| SMS Block | £1.00 |

| SMS Unblock | £1.00 |

| Administrative Transactions | |

| Lost Replacement Card | £9.99 |

| Stolen Replacement Card | £9.99 |

| Administrative Fee | £5.00 |

| Card Cash Out/ Card Refund Fee | £10.00 |

| Customer Services Fee Per Call | £0.65 |

| ATM Usage | |

| ATM Withdrawal in the UK | £0.99 |

| ATM Withdrawal Outside the UK | £1.50 |

| POS Transactions | |

| UK POS Fee | FREE |

| International POS Fee FX Spend | FREE 2.50% |

| All Decline Fees | £0.25 |

| IVR Fees | |

| Initial PIN Enquiry | £1.00 |

| Subsequent PIN Enquiry | £0.50 |

| Miscellaneous Fees | |

| Upgrade Fee Wages Transfer

Bank Payment | £2.00 £1.00

£1.00 |

| Monthly Inactivity Fee (after 90 days of inactivity) | £1.00 |

| Loads And Limits | |

| Yearly Load Limit / Non KYC | £2,000.00 |

| Yearly Load Limit ‘PLUS’ | £15,000.00 |

| Max Load | £5,000.00 |

| Max Credit/Debit Card Load | £500.00 |

| Max Card to Card Transfer | £750.00 |

| Max Loads Per Day | 3 |